As someone who has navigated the home buying process twice, I've spent countless hours experimenting with different mortgage calculators. Whether you're searching for a new home or considering refinancing your current loan, a reliable mortgage calculator is an essential tool for making informed financial decisions. Today, I'm sharing my personal experiences with the top 5 free online mortgage calculators that have helped me make smarter financial choices.

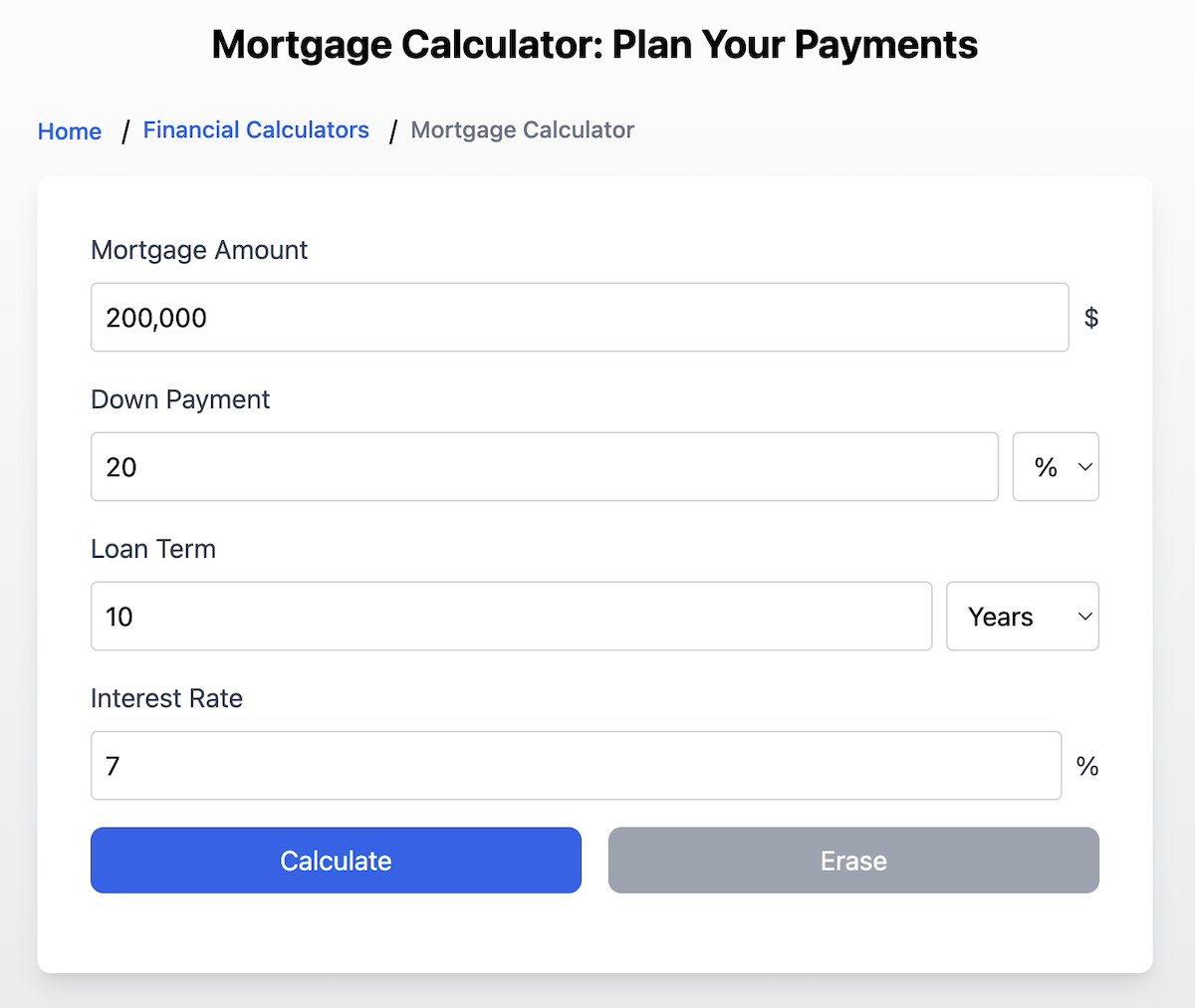

1. Calculators.im - Simple and Efficient

When I first started exploring the mortgage process, I stumbled upon the mortgage calculator at Calculators.im. This quickly became one of my favorites due to its simplicity and user-friendly interface.

Key Features:

- Clean, intuitive interface without unnecessary clutter

- Quick calculation of monthly payments

- Clear visualization of principal vs. interest over time

- Ability to adjust loan amount, interest rate, and term

- Detailed amortization table that helped me understand cash flow year by year

Experience it yourself: https://calculators.im/mortgage-calculator " > https://calculators.im/mortgage-calculator

Personal Experience: What I particularly love about Calculators.im is how it visually displays the loan payoff timeline. When I was debating between a 15-year and 30-year mortgage, this tool clearly showed me the difference in total interest costs—ultimately saving me tens of thousands of dollars over the life of my loan. The straightforward design made it easy to experiment with different scenarios without feeling overwhelmed.

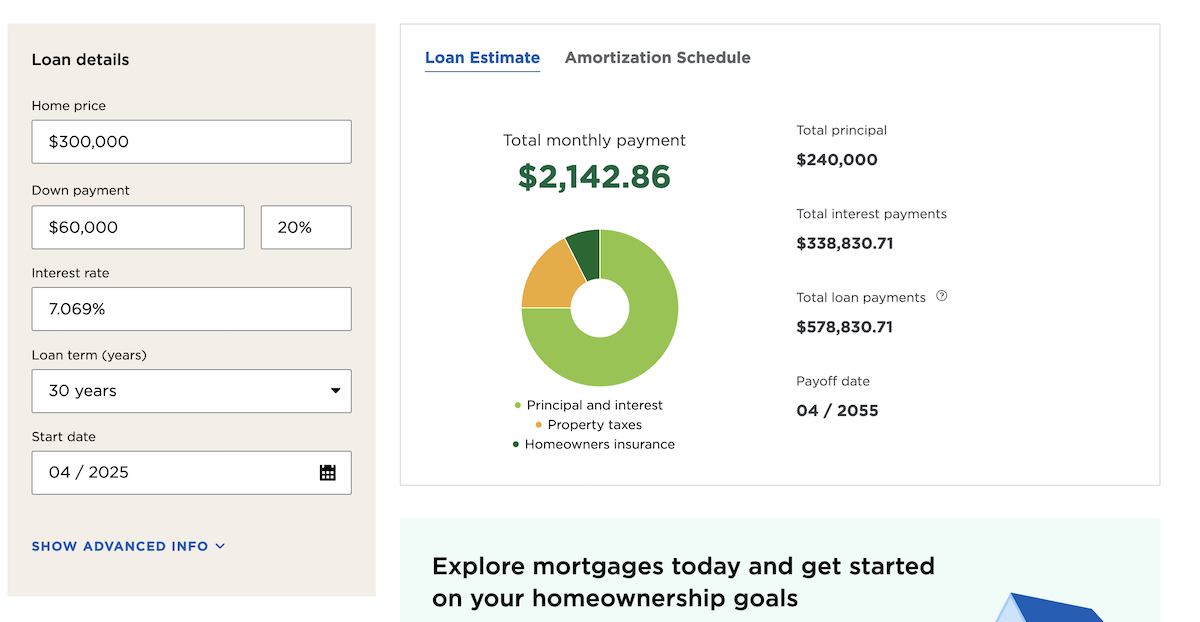

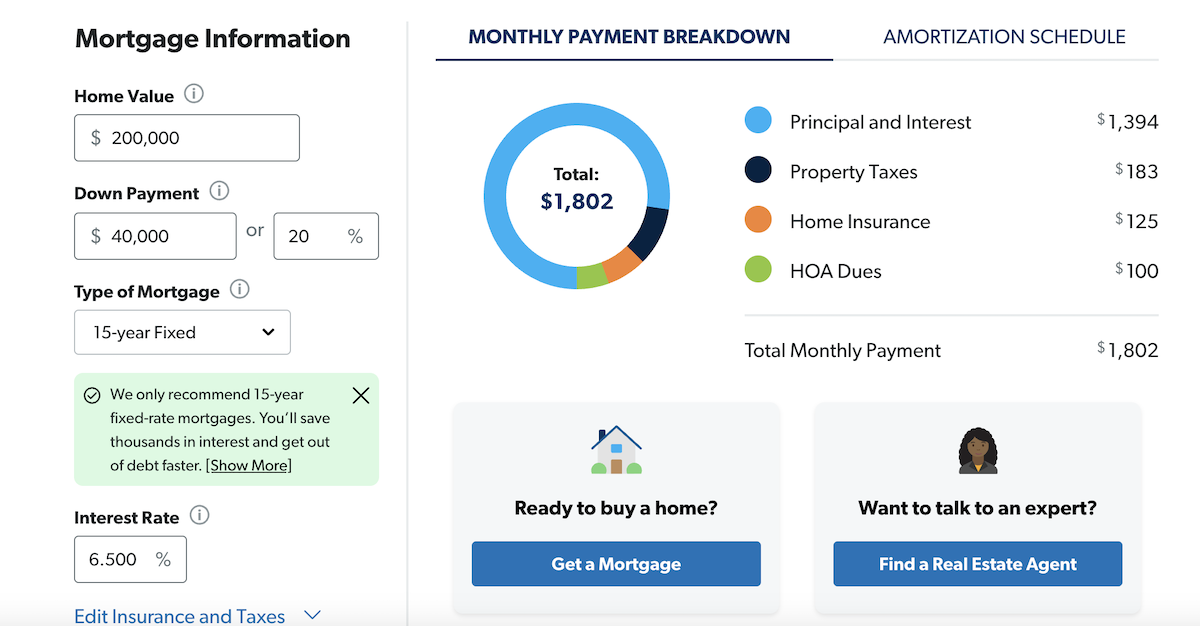

2. NerdWallet Mortgage Calculator - Most Comprehensive Option

NerdWallet is a trusted name in financial information, and their mortgage calculator didn't disappoint. This is the most comprehensive calculator I've used, incorporating all aspects of homeownership costs.

Key Features:

- Detailed calculations including taxes, insurance, and PMI (Private Mortgage Insurance)

- Comprehensive amortization schedule

- Interest rate comparison tool

- Affordability calculator function

- Integration with current market rate information

Experience it yourself: https://www.nerdwallet.com/mortgages/mortgage-calculator " target="_blank" rel="nofollow"> https://www.nerdwallet.com/mortgages/mortgage-calculator

Personal Experience: When considering my second home purchase, I used NerdWallet's calculator to get a complete assessment of the associated costs. What I appreciated most was its ability to factor in additional expenses like property taxes and homeowners insurance—costs that many other calculators overlook. This gave me a much more realistic view of the total cost of homeownership. The detailed amortization schedule also helped me understand how much of my early payments would go toward interest versus principal.

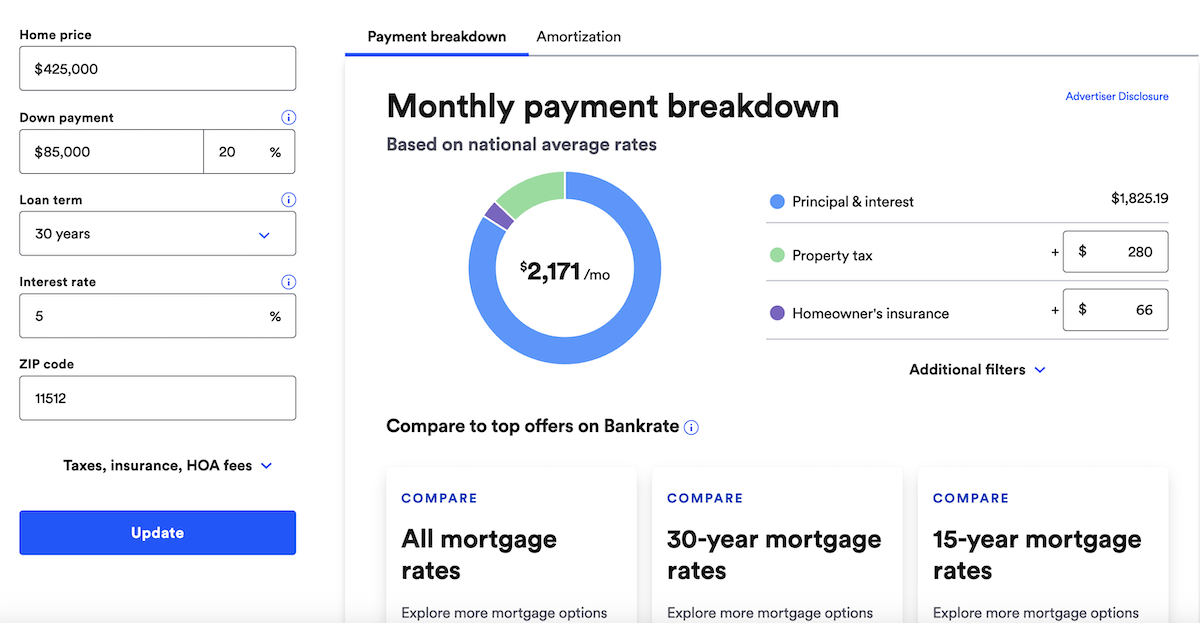

3. Bankrate Mortgage Calculator - Best for Beginners

Bankrate's mortgage calculator is one of the most beginner-friendly tools I've encountered. When I was first learning about mortgages, I found their interface easy to understand and not intimidating.

Key Features:

- Simple, beginner-friendly interface

- Abundant guidance and term explanations

- Includes down payment and refinance calculators

- Comparison features for different loan types

- Educational articles about the mortgage process

Experience it yourself: https://www.bankrate.com/mortgages/mortgage-calculator/ " target="_blank" rel="nofollow"> https://www.bankrate.com/mortgages/mortgage-calculator/

Personal Experience: When I first started exploring home loans, I felt overwhelmed by the terminology and complex processes. Bankrate's calculator not only helped me calculate payments but educated me on the entire process. I particularly appreciated the accompanying tutorial articles that clearly explained concepts like PMI, points, and fixed versus adjustable rates. Their calculator became my go-to resource for learning the basics before diving into more complex calculations.

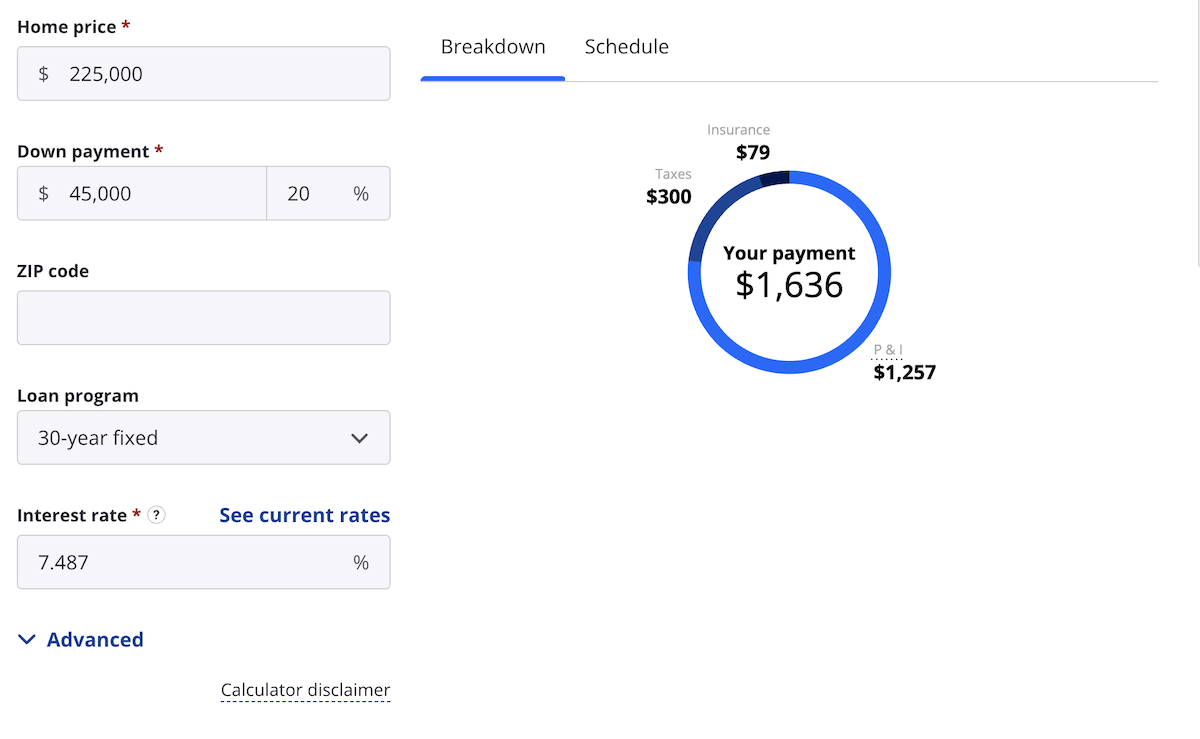

4. Zillow Mortgage Calculator - Best for Viewing Specific Properties

If you're actively house hunting, Zillow's mortgage calculator is an excellent choice as it integrates directly with their property listings.

Key Features:

- Integration with real estate data

- Auto-fills property taxes and assessments for specific homes

- Buy vs. rent comparison feature

- Displays available loan options from multiple lenders

- Calculates closing costs and other fees

Experience it yourself: https://www.zillow.com/mortgage-calculator/ " target="_blank" rel="nofollow"> https://www.zillow.com/mortgage-calculator/

Personal Experience: Once I had narrowed down my search to a few potential homes, Zillow's calculator helped me compare the actual costs between them. What I loved most was its ability to pull in real property tax information and estimated insurance based on the home's location, making calculations more accurate. I also used the buy vs. rent comparison feature to confirm that buying was indeed the right financial decision for me at that time.

5. Dave Ramsey Mortgage Calculator - Best for Debt Payoff Planning

Dave Ramsey is a well-known financial expert, and his mortgage calculator is particularly useful for those looking to pay off debt quickly.

Key Features:

- Focus on early debt payoff

- Additional payment calculation feature

- Shows savings from prepayment

- Aligns with "debt-free" financial philosophy

- Clearly displays the impact of extra payments

Experience it yourself: https://www.ramseysolutions.com/real-estate/mortgage-calculator " target="_blank" rel="nofollow"> https://www.ramseysolutions.com/real-estate/mortgage-calculator

Personal Experience: About a year after purchasing my home, I became interested in strategies to pay off my mortgage early. Dave Ramsey's calculator showed me that by adding just $300 extra per month, I could shorten my 30-year mortgage to about 22 years and save nearly $50,000 in interest. This motivated me to adjust my budget and start making additional payments. The visual representation of how each extra payment reduced my loan term was incredibly motivating.

Comparison of Calculators

| Calculator | Strengths | Weaknesses | Best For |

|---|

| Calculators.im | Simple, visual, easy to use | Fewer advanced features | Beginners, quick calculations |

| NerdWallet | Comprehensive, includes all costs | Can be overwhelming initially | Those wanting detailed analysis |

| Bankrate | User-friendly, educational | Fewer customization options | First-time homebuyers |

| Zillow | Integration with real property data | Requires personal information for some features | Active home searchers |

| Dave Ramsey | Focus on early payoff | Fewer comparison features | Those wanting to pay off debt quickly |

How to Effectively Use a Mortgage Calculator

After years of using these tools, I've learned some tips to maximize their value:

- Understand the inputs: Make sure you understand what you're entering. Loan amount, interest rate, and term are the basics, but property taxes, insurance, and PMI significantly affect your monthly payment too.

- Test different scenarios: Adjust down payments, loan terms, and interest rates to see different scenarios. I ran dozens of scenarios and discovered that in my case, opting for a 20-year loan instead of a 30-year was the best financial choice.

- Consider total ownership costs: Mortgage payments are just one part of homeownership costs. Don't forget to account for maintenance, repairs, and utility costs.

- Compare loan types: Use these tools to compare fixed-rate loans with adjustable-rate mortgages (ARMs), as well as different terms (15, 20, 30 years).

- Assess realistic affordability: Just because a calculator shows you can qualify for a large loan doesn't mean you should take it. I decided to borrow less than I qualified for to maintain financial comfort.

Conclusion

After using all these mortgage calculators, I've found that each has strengths that suit different stages of the home buying journey. Calculators.im is excellent for quick, visual calculations. NerdWallet provides the deepest analysis. Bankrate is ideal for newcomers. Zillow integrates well with actual home searching. And Dave Ramsey focuses on getting debt-free quickly.

I recommend trying all five to see which one fits your needs and style best. Ultimately, mortgage calculators are valuable resources that help you make informed financial decisions about one of the biggest investments of your life.

Remember, while these calculators are incredibly helpful, they're just a starting point. I still recommend consulting with a financial advisor or mortgage counselor for personalized guidance specific to your situation.

Have you used any of these mortgage calculators? What has your experience been with the ones I've mentioned? Share in the comments below!